Excel Goal Seek Tutorial |

您所在的位置:网站首页 › excelgoalseek › Excel Goal Seek Tutorial |

Excel Goal Seek Tutorial

|

This post is part of spreadcheats series. Today we will learn a fascinating little feature in excel called “goal seek”. But what good is a feature if we cant find a use for it? So we will build a simple retirement calculator using excel. Before plunging in to the complex retirement calculations, let us spend a bunch of words understanding what this goal seek is all about. What is goal seek in excel?

For example, you can use goal seek to solve a linear equation or find the internal return rate (IRR) of an investment. Now that you understand goal seek, let us plan your retirement. 🙂 Make a financial model to estimate your monthly savings to meet retirement goals.

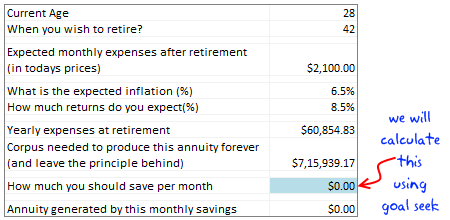

(Note: the image shows commas according to Indian currency formatting.) In order to proceed, we would need some data, like, (1) What is your current age? (2) What is your expected retirement age? (3) How much do you think you will spend every month when you retire (of course in today’s prices) (4) Your expectation of inflation (%)? (5) Your expected return (%) on investments? Once the data is available, we will need to calculate the following, I have shown the worksheet on the right with some dummy data. (6) The yearly expenses at the time of retirement: (3) * (1+(4))^((2)-(1))*12 (7) Corpus required to generate the above amount every year (and leave the principle behind): (6)/(5) (If these calculations are overwhelming, download the excel retirement calculator workbook here.) We know how much corpus is needed. We can use FV() formula to determine the future value of a series of payments made periodically and compounded at a given interest rate. We know how much the FV() out come should be, but we don’t know how much the input (monthly investment) should be. This is where goal seek is going to help us. Let us assume the monthly investment amount will be in cell A5. Let us also assume, the interest rate is in cell A4, retirement age is in A3, current age is in A2. We will write the FV formula in cell A6 like this = -FV(A4/12,(A3-A2)*12,A5) (we have to negate FV since it uses weird accounting notations) Since the cell A5 is blank, the FV will show the value as 0. Now, we will use goal seek to find out how much cell A5 should have so that A6 will be calculated to the corpus amount required. Go to Data tab and click on What if analysis and select goal seek. (In excel 2003, it should be in tools menu) See this screen cast to understand how the goal seek works:

The goal seek window has 3 inputs. The cell you need to change. The cell you want to set and the value to set. Once you use the goal seek it will find the correct (or closest) value to meet the goal and displays it. If you press OK, the value will be placed in the cell (in our case, in A5) That is all. Download the Retirement Calculator Excel Worksheet and play with itClick here to download the retirement calculator worksheet. Follow the instructions in the workbook to see this example for yourself. Change values to find the amount that you need to save. Do you find goal seek feature useful?What do you do with excel goal seek? Do you use it in your modeling, planning worksheets? Tell me your experiences and ideas using comments. Additional resources: Read remaining posts in Spreadcheats series: Become a spreadsheet guru by learning these nifty hacks. Excel financial formulas – Help on NPV, FV, PV and more Understand why you should start early when it comes to retirement savings Buy or rent calculator in Excel – calculate returns on property investmentsPS: the retirement calculation steps are derived from this excellent article on smart investor |

【本文地址】

今日新闻 |

推荐新闻 |