EFX Review, Forex Broker&Trading Markets, Legit or a Scam |

您所在的位置:网站首页 › efxs › EFX Review, Forex Broker&Trading Markets, Legit or a Scam |

EFX Review, Forex Broker&Trading Markets, Legit or a Scam

|

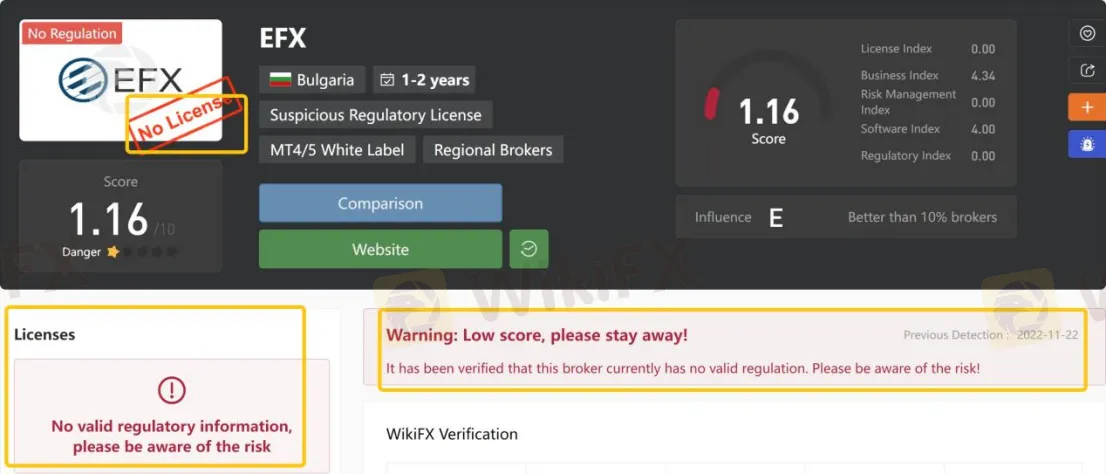

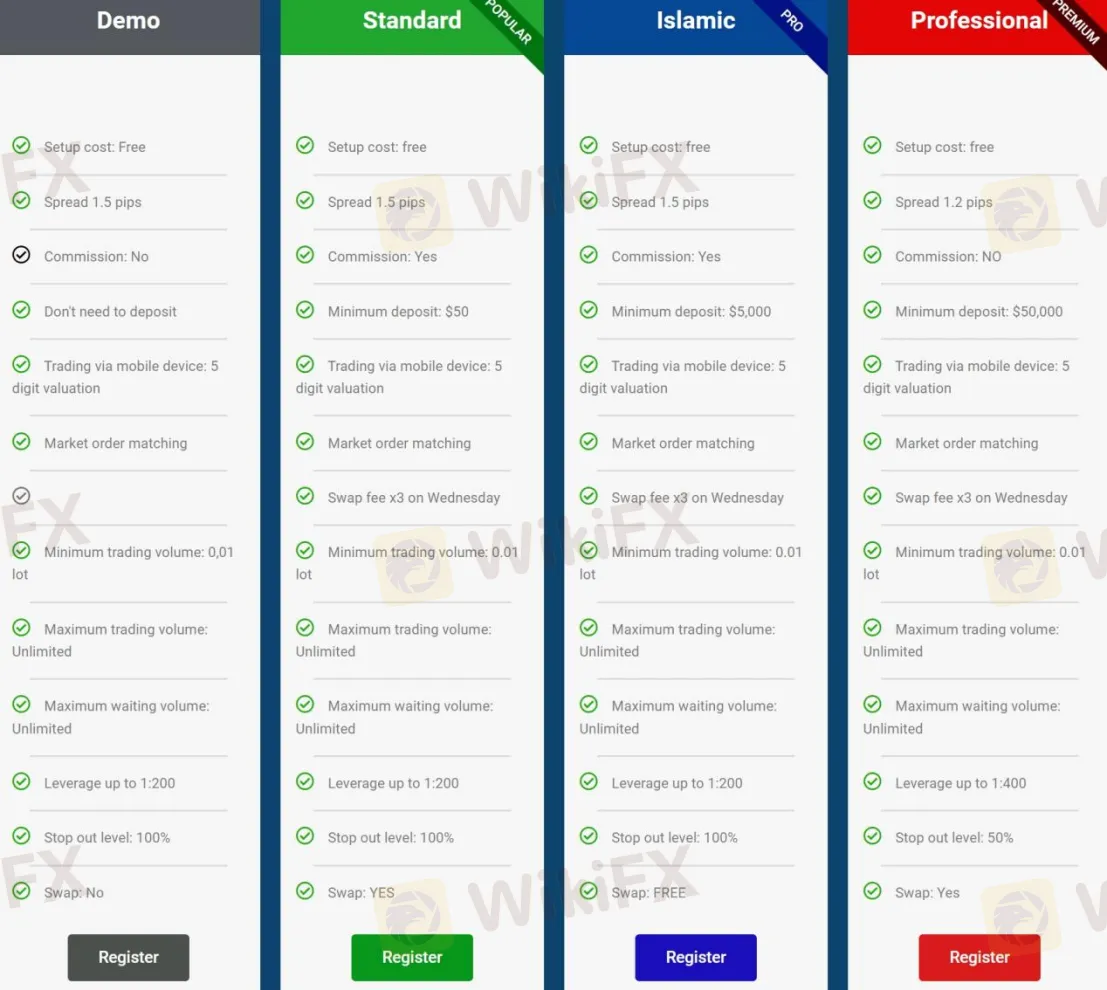

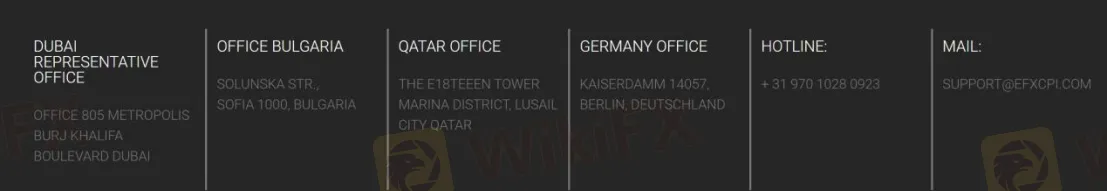

Risk Warning Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only. General Information & Regulation Feature Detail Regulation No Regulation Market Instrument forex, index, commodities, stock and cryptocurrencies Account Type Standard, Islamic and VIP Demo Account yes Maximum Leverage 1:400 Spread demo, Standard and Islamic: from 1.5 pips | VIP: from 1.2 pips Commission demo & VIP: no | Standard & Islamic: yes Trading Platform MT4 for PC, Mac, Android, iPhone, iPad and WebTrader Minimum Deposit $50 Deposit & Withdrawal Method Visa, Skrill, MasterCard and NetellerEFX, a trading name of EFX CPI LLC, is allegedly a forex and CFD broker registered in Bulgaria that claims to provide its clients with various tradable financial instruments with flexible leverage up to 1:400 and floating spreads from 1.2 pips on the MT4 trading platform via 3 different live account types, as well as 24/5 customer support service. Here is the home page of this brokers official site:  As for regulation, it has been verified that EFX currently has no valid regulation. That is why its regulatory status on WikiFX is listed as “No License” and receives a relatively low score of 1.16/10. Please be aware of the risk.  Market Instruments EFX advertises that it offers 108+ products to trade, including forex, index, commodities, stock and cryptocurrencies.  Account Types Apart from demo accounts, EFX claims to offer 3 types of live trading accounts - Standard, Islamic and VIP, with minimum initial deposit requirements of $50, $5,000 and $50,000 respectively.  Leverage The specified leverage for different account types at EFX varies between 1:200 and 1:400. Specifically, 1:200 for the demo, Standard and Islamic accounts, and 1:400 for the VIP account. It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you. Spreads & Commissions All spreads with EFX are a floating type and scaled with the accounts offered. For example, the spread starts from 1.5 pips on demo, Standard and Islamic accounts, while from 1.2 pips on the VIP account. As for the commission, there is no commission charged on demo and VIP accounts, while the Standard and Islamic accounts have to pay some unspecified commissions. Trading Platform Available The platform available for trading at EFX is one of the most notable and preferred trading platforms the market offers - MetaTrader4 for PC, Mac, Android, iPhone, iPad and WebTrader. This trading terminal is highly praised by traders and brokers alike due to its ease of use and great functionality. The MT4 offers top-notch charting and flexible customization options. It is especially popular for its automated trading bots, a.k.a. Expert Advisors.  Deposit & Withdrawal From the logos shown at the foot of the home page on EFXs official website, we found that this broker seems to accept numerous means of deposit and withdrawal choices, consisting of Visa, Skrill, MasterCard and Neteller. The minimum initial deposit requirement is $50.  Bonuses EFXs website claims to offer a 20% deposit bonus for a live account. In any case, you should be very cautious if you receive a bonus. Bonuses aren't client funds, they're company funds, and fulfilling the heavy requirements that are usually attached to them can prove a very daunting and difficult task. Note that brokers are prohibited from using bonuses and promotions by all leading regulators. Customer Support EFXs customer support can be reached by telephone: +31 970 1028 0923, email: [email protected] or send messages online to get in touch. You can also follow this broker on social networks such as Twitter, Facebook, Instagram and WhatsApp. Company address: DUBAI REPRESENTATIVE OFFICE: OFFICE 805 METROPOLIS BURJ KHALIFA BOULEVARD DUBAI; OFFICE BULGARIA: SOLUNSKA STR., SOFLA 1000, BULGARIA; QATAR OFFICE: THE E18TEEEN TOWER MARINA DISTRICT, LUSAIL CITY QATAR; GERMANY OFFICE: KAISERDAM 14057, BERLIN, DEUTSCHLAND.  Pros & Cons Pros Cons • Multiple instruments, account types and payment options offered • No regulation • Demo accounts available • MT4 supported • Unspecified commission charged • Low minimum deposit ($50)Frequently Asked Questions (FAQs) Q 1: Is EFX regulated? A 1: No. It has been verified that EFX currently has no valid regulation. Q 2: Does EFX offer demo accounts? A 2: Yes. Q 3: Does EFX offer the industry-standard MT4 & MT5? A 3: Yes. EFX supports MT4 for PC, Mac, Android, iPhone, iPad and WebTrader. Q 4: What is the minimum deposit for EFX? A 4: The minimum initial deposit with EFX is $50. Q 5: Does EFXcharge a fee? A 5: Like every forex broker, EFX charges a fee when you trade - either in the form of a commission fee or spread fee. While the information on other fees like deposits & withdrawals is missing. Q 6: Is EFX a good broker for beginners? A 6: No. EFX is not a good choice for beginners. Although it offers demo accounts on the industry-standard MT4, it lacks legal regulation and fees are non-transparent. |

【本文地址】

今日新闻 |

推荐新闻 |